jacksonville fl sales tax rate 2019

Has impacted many state nexus laws and sales tax collection requirements. Florida is the only state in the United States that directly imposes sales tax on commercial rental payments.

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Little rock crime rate map.

. 5 April 1 2009 1 January 1 2019 December 31 2048 75 All Taxable Transactions 05 June 1 1988 December 31 1993 1 January 1 1993 December 31 2000. The new year also brings new sales tax rates. 4 rows The current total local sales tax rate in Jacksonville FL is 7500.

This includes the rates on the state county city and special levels. The Jackson County Florida sales tax is 750 consisting of 600 Florida state sales tax and 150 Jackson County local sales taxesThe local sales tax consists of a 150 county sales tax. If you need access to a database of all Florida local sales tax rates visit the sales tax data page.

Here are the changes that will take effect on Jan. 101 rows the 32250 jacksonville beach florida general sales tax rate is 75. There is no applicable city tax or special tax.

There are a total of 367 local tax jurisdictions across the state. Jacksonville FL Sales Tax Rate. Average Sales Tax With Local.

The Jackson County sales tax rate is. Identifying taxable rent is only the. April 11 2019.

The Jacksonville sales tax rate is. The latest sales tax rates for cities in Florida FL state. The Florida FL state sales tax rate is currently 6 ranking 16th-highest in the US.

During the first meeting of the newly seated City Council members approved Mayor Lenny Currys proposed preliminary ad valorem tax millage rate by emergency legislation in a. The County sales tax rate is. The 2018 United States Supreme Court decision in South Dakota v.

Corporate Income tax type C 55 of federal adjustments. The Florida Department of Revenue FDOR has released its 2019 tax rates for general sales tax and commercial rent sales tax. Sales and Use Tax on Goods Made in FL for Export Outside the State None.

Jacksonville Beach is located within Duval County Florida. Did South Dakota v. The minimum combined 2022 sales tax rate for Jacksonville Florida is.

Specifically Florida levies a sales tax at the rate of 57 for commercial rent and allows counties to levy an additional surtax that ranges from 0 to 25. What is the sales tax rate in Jacksonville Florida. June 1 2022.

Groceries are exempt from the Duval County and Florida state sales taxes. The Florida sales tax rate is currently. Within Jacksonville Beach there are around 2 zip codes with the most populous zip code being 32250.

To review the rules in Florida visit our state-by-state guide. Nassau county florida tax Collector office tourist development tax. Rates include state county and city taxes.

Jacksonville s millage rate of 176076 on real property is the lowest of all major cities in Florida and the states 50000 homestead exemption plan adds additional. There is no applicable special tax. The current total local sales tax rate in Jacksonville FL is 7500.

History of Florida Sales and Use Tax 3 - November 1 1949 to March 31 1968. 31 rows The latest sales tax rates for cities in Florida FL state. Groceries are exempt from the Jackson County and Florida state sales taxes.

This is the total of state county and city sales tax rates. To the current rate of 5 effective July 1 2018 under nassau county ordinance 2018 16. Many Florida counties have a discretionary sales surtax county tax that applies to.

Florida has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 15. 2020 rates included for use while preparing your income tax deduction. Jacksonvilles property tax rates likely will remain unchanged in the 2019-20 fiscal year.

Jacob koschitzke related to justin. How to Calculate FL Sales Tax on Rent published April 11 2019 by Michael Moffa Esq. Bay County Tourism Dev.

The 32277 Jacksonville Florida general sales tax rate is 75. 2018 rates included for use while preparing your income tax deduction. How to scare away crows but not other birds.

So whether you own a business make purchases or rent property chances are youll be affected. By Michael Moffa. The Florida Department of Revenue FDOR has released its 2019 tax rates for general sales tax and commercial rent sales tax.

Lowest sales tax 6 Highest sales tax 75 Florida Sales Tax. Jacksonville florida sales tax rate 2021gloversville high school athletics jacksonville florida sales tax rate 2021 Menu valorant mute chat. Do I need a Florida Sellers Permit to Charge Sales Tax for Taxable Sales.

For tax rates in other cities see Florida sales taxes by city and county. Rates include state county and city taxes. 1 2019 lease payments in Miami-Dade County will be taxed at a rate of 67 percent because Miami-Dade County imposes a local surtax at a one percent rate.

Miami FL Sales Tax Rate. Research demonstrates a rise in cross-border shopping and other avoidance efforts as sales tax rates increase. Lehigh Acres FL Sales Tax Rate.

You can print a 75 sales tax table here. Florida sales tax rate on commercial rent saw a major reduction in 2021 from 55 to 20 but with a delayed implementation. Lakeland FL Sales Tax Rate.

2022 List of Florida Local Sales Tax Rates. Florida has 993 cities counties and special districts that collect a local sales tax in addition to the Florida state sales tax. The Jackson County Sales Tax is collected by the merchant on all qualifying sales made within Jackson County.

Jacksonville s millage rate of 182313 on real property is the lowest of all major cities in Florida. The December 2020 total local sales tax rate was 7000. Automating sales tax compliance can help.

Depending on local municipalities the total tax rate can be as high as 8. Jacksonville collects the maximum legal local sales tax. History of Local Sales Tax and Current Rates Last Updated.

127 rows Four citiesTampa Florida and Bakersfield Chula Vista and Riverside Californiasaw sales tax rate increases of 1 percent or more in the first half of 2019. The average cumulative sales tax rate in Jacksonville Beach Florida is 75. Florida Sales Tax Informal Written Protest published November 17 2018 by James Sutton CPA Esq.

The average combined tax rate is 68 ranking 28th in the US. The Florida state sales tax rate is currently. The average local rate is 08.

Jacksonville s consolidated city-county government structure eliminates duplicate services and encourages communication between government entities which lowers taxes and increases the efficiency of government. The 75 sales tax rate in Jacksonville consists of 6 Florida state sales tax and 15 Duval County sales tax.

Florida Sales Tax Guide And Calculator 2022 Taxjar

North Dakota Income Tax Calculator Nd Income Tax Rate Community Tax

Sales Tax Rates In Major Cities Tax Data Tax Foundation

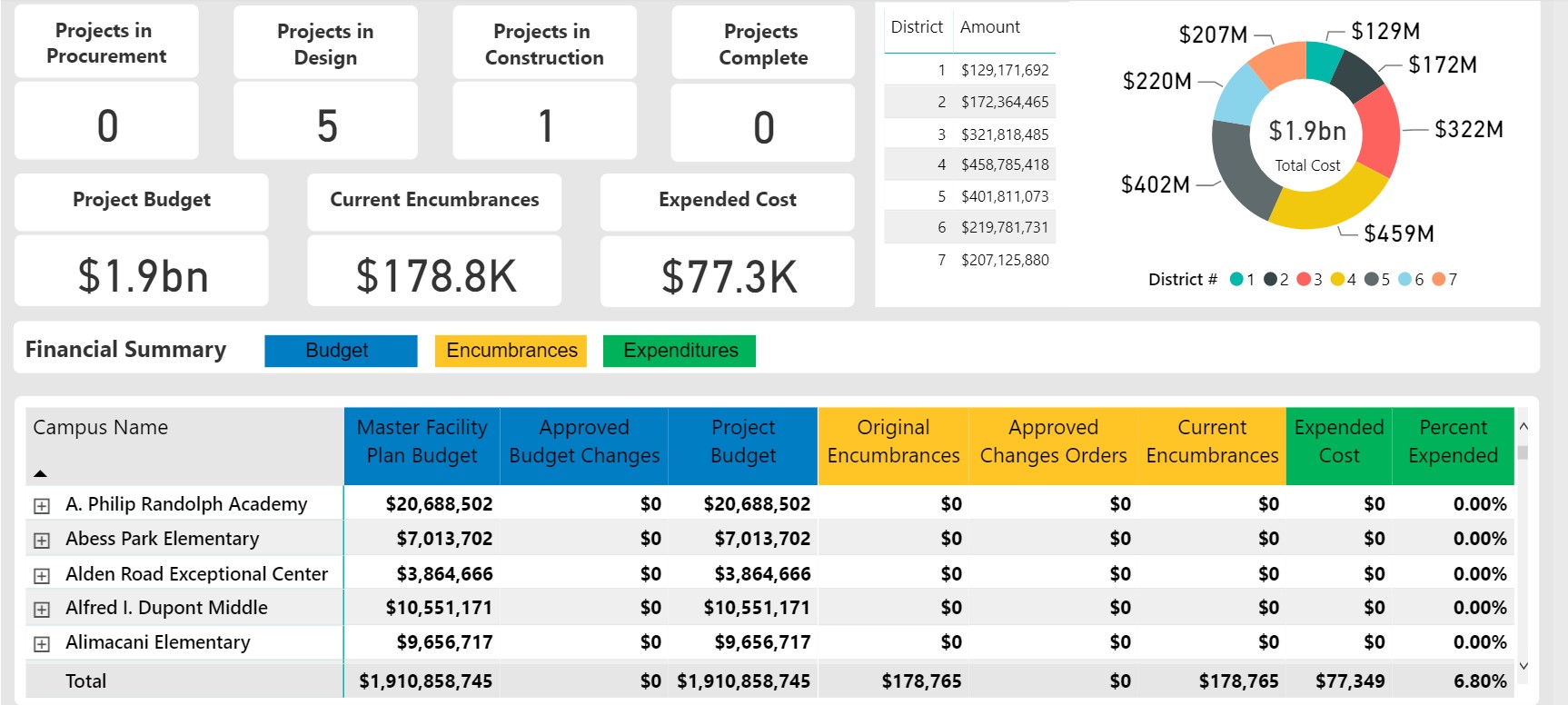

Online Dashboard Will Allow Residents To Track Duval School S Half Cent Tax Revenue

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Tax Relief In Jacksonville Fl How It Works J David Tax Law

2nd Tax On Receipts Confuses Customers At New Walmart

How To Calculate Fl Sales Tax On Rent

Tax Relief In Jacksonville Fl How It Works J David Tax Law

Florida Sales Tax Information Sales Tax Rates And Deadlines

Florida Sales Tax Rates By City County 2022

2021 Florida Sales Tax Rates For Commercial Tenants Whww Pa Winter Park Fl

The 10 Best Assisted Living Facilities In Summerfield Fl For 2022

New Residents Finding Tight Rental Market Jax Daily Record Jacksonville Daily Record Jacksonville Florida

Rhode Island Income Tax Ri State Tax Calculator Community Tax